501c3 Nonprofit for Beginners

Wiki Article

Non Profit Org for Dummies

Table of ContentsThe smart Trick of 501 C That Nobody is Talking AboutThe Not For Profit Organisation PDFsGet This Report on Nonprofits Near MeThe 10-Second Trick For Not For Profit OrganisationNon Profit Organization Examples Things To Know Before You Get ThisSome Ideas on 501c3 You Need To KnowGoogle For Nonprofits for DummiesThe Facts About Irs Nonprofit Search RevealedThe smart Trick of Non Profit That Nobody is Talking About

Incorporated vs - 501c3 nonprofit. Unincorporated Nonprofits When people believe of nonprofits, they commonly think of bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and various other formally created organizations. Nevertheless, lots of people participate in unincorporated nonprofit organizations without ever before recognizing they've done so. Unincorporated nonprofit organizations are the result of 2 or more individuals working together for the objective of supplying a public advantage or service.Exclusive structures might consist of household foundations, exclusive operating structures, and company foundations. As kept in mind over, they commonly don't supply any kind of services and also instead make use of the funds they elevate to support various other charitable organizations with solution programs. Private foundations likewise often tend to require even more start-up funds to establish the company along with to cover lawful fees and also various other recurring expenditures.

Not known Details About Nonprofits Near Me

The properties remain in the depend on while the grantor lives and the grantor might handle the properties, such as acquiring and selling stocks or property. All properties transferred into or bought by the trust continue to be in the depend on with income distributed to the designated recipients. These trust funds can endure the grantor if they consist of a provision for recurring administration in the paperwork used to develop them.

Unknown Facts About 501c3

Alternatively, you can employ a depend on lawyer to assist you produce a charitable depend on and suggest you on exactly how to manage it progressing. Political Organizations While many various other types of not-for-profit organizations have a limited capacity to take part in or supporter for political task, political organizations operate under different rules.

Rumored Buzz on Non Profit Org

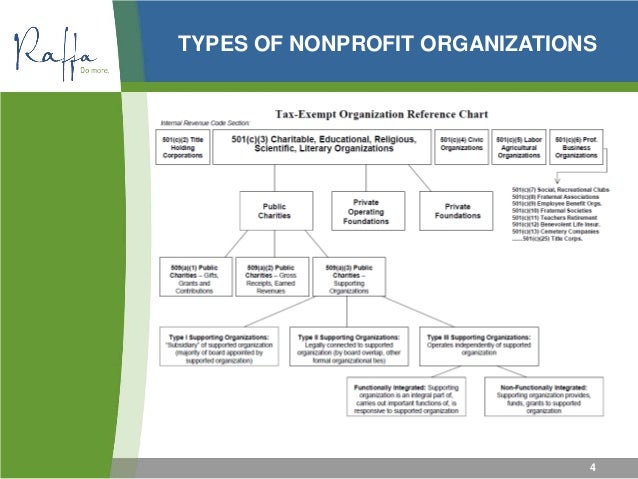

As you review your choices, be certain to talk to an attorney to identify the most effective method for your organization and to guarantee its correct arrangement.There are lots of kinds of nonprofit organizations. All properties and also revenue from the nonprofit are reinvested right into the organization or donated.

The 20-Second Trick For 501c3 Nonprofit

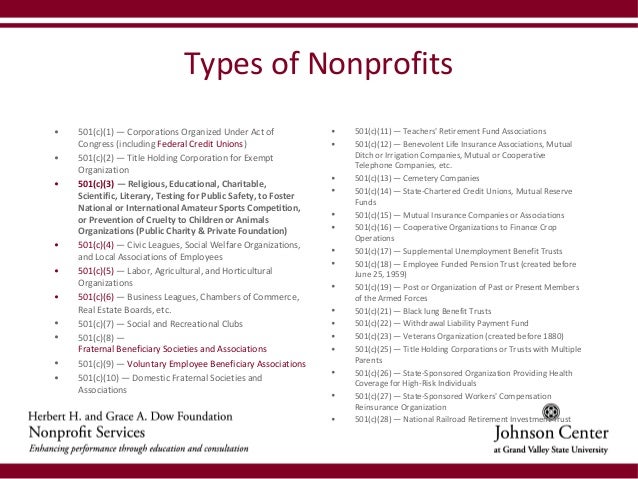

Some instances of popular 501(c)( 6) companies are the American Ranch Bureau, the National Writers Union, and also the International Association of Meeting Organizers. 501(c)( 7) - Social or Recreational helpful site Club 501(c)( 7) companies are social or entertainment clubs.

The Only Guide to 501c3 Organization

501(c)( 14) - State Chartered Credit Rating Union and also Mutual Get Fund 501(c)( 14) are state chartered credit history unions as well as shared book funds. These companies provide monetary services to their participants and also the area, typically at affordable prices.In order to be qualified, at least 75 percent of participants have to exist or previous members of the USA Armed Forces. Funding comes from donations and government grants. 501(c)( 26) - State Sponsored Organizations Providing Health Protection for High-Risk Individuals 501(c)( 26) are nonprofit organizations developed at the state level to provide go to the website insurance policy for high-risk individuals who might not have the ability to obtain insurance coverage via various other ways.

Excitement About 501c3 Nonprofit

501(c)( 27) - State Sponsored Employee' Compensation Reinsurance Company 501(c)( 27) not-for-profit organizations are created to supply insurance for employees' payment programs. Organizations that give workers payments are needed to be a participant of these companies and also pay fees.A nonprofit company is an organization whose purpose is something aside from making an earnings. non profit organizations near me. A nonprofit donates its income to achieve a certain goal that benefits the general public, rather than distributing it to shareholders. There more than 1. 5 million not-for-profit organizations signed up in the United States. Being a not-for-profit does not suggest the organization will not earn a profit.

7 Easy Facts About Non Profit Organizations Near Me Shown

Nobody individual or team possesses a not-for-profit. Properties from a nonprofit can be marketed, yet it benefits the entire organization as opposed to people. While any individual can incorporate as a not-for-profit, just those that pass the stringent requirements established forth by the federal government can attain tax obligation exempt, or 501c3, standing.We talk about the actions to becoming a nonprofit more right into this web page.

The Best Strategy To Use For Irs Nonprofit Search

The most important of these is the ability to acquire tax "excluded" status with the IRS, which permits it to obtain contributions cost-free of gift tax, enables benefactors to subtract contributions on their revenue tax obligation returns as well as spares some of the company's activities from revenue taxes. Tax obligation excluded condition is essential to lots of nonprofits as it encourages contributions that can be used to support the mission of the organization.Report this wiki page